The DeFi world has seen huge change. It now holds $100 billion USD, thanks to blockchain tech and being decentralized. This shows a big change in how we look at, use, and get financial services.

DeFi changes finance by cutting out the middleman. It makes finance open to all, more clear, and runs better. You can do lots of things like loaning, borrowing, trading, and buying insurance easily. All this happens with smart contracts and open protocols. The main things pushing DeFi forward are clearness, safety, working with others, and being easy to get to.

DeFi beats usual finance in many ways. You pay less, your deals are done quickly, you control your money more, and you can use a lot of financial tools without a lot of paperwork or checks. But, growing DeFi has some bumps, like how big it can get, rules in different places, faults in smart contracts, and not always great user experiences.

The DeFi field keeps getting better. People in the industry watch closely for new DeFi trends and tech. This could change how we all get and use money services, helping people and companies all over.

Key Takeaways

- DeFi platforms offer lower fees, faster transaction settlements, and greater autonomy over assets compared to traditional financial systems.

- DeFi seeks to democratize finance by eliminating intermediaries and fostering a more inclusive, transparent, and efficient financial ecosystem.

- Decentralized finance platforms provide access to a wide range of financial instruments without extensive documentation or credit checks.

- The DeFi ecosystem faces challenges such as scalability issues, regulatory uncertainties, and user experience limitations.

- The integration of DeFi with traditional finance presents a transformative opportunity to reshape the financial landscape.

Decentralized Finance (DeFi): A Paradigm Shift

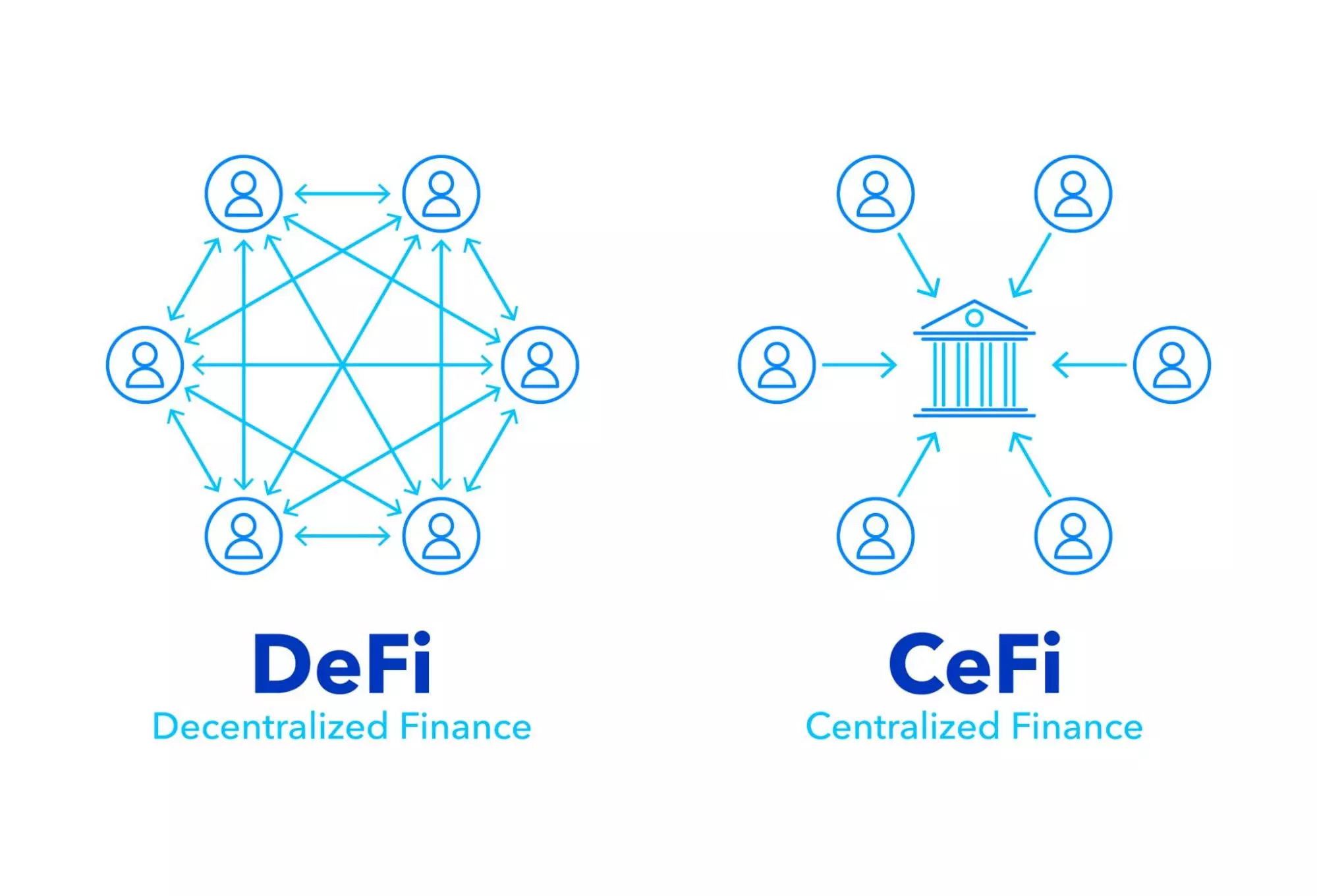

The rise of DeFi platforms is changing finance. They offer many services like loans, trading, and insurance through smart contracts. This means people can do business with each other without banks or brokers.

Emergence of Blockchain and Decentralization

DeFi grows thanks to key ideas like being open, safe, easy to use, and available to all. It uses blockchain to make all transactions clear and safe. It makes it easy for different apps to work together, and opens finance up to everyone online.

Principles of DeFi: Transparency, Security, and Accessibility

DeFi is better than old finance in many ways. It has lower fees and lets you control your money more. Plus, you can use lots of financial tools without lots of paperwork. People are choosing DeFi for these reasons.

Advantages of DeFi over Traditional Finance

DeFi is a big change in finance. It lets people and companies work without the usual go-betweens. This new way of doing finance is more yours to control and is for everyone who’s connected to the internet.

Traditional Finance Meets DeFi: A Symbiotic Relationship

Decentralized finance (DeFi) has changed the way we look at money. It offers a new approach apart from traditional ways. Many folks now wonder how DeFi and traditional finance can work together.

Strengths of Traditional Finance

Traditional finance is built on banks, investment firms, and rules. This structure provides safety, trust, and helps prevent huge losses. It’s the solid base of our money world, serving everyone from people to big companies and governments.

The Promise of Decentralized Finance

DeFi flips the script by using blockchain to give us new kinds of financial tools. It’s all about clear rules, safety, no one saying who can join, cool features, and letting anyone in the world be part of it. With DeFi, you can make deals straight with others, skipping the middleman. This opens money doors for all.

Fostering Collaboration Between Traditional and DeFi

Instead of fighting, traditional and DeFi could team up. Joining their powers could lead to a money world that mixes the best of both. This way, we could see new financial services that are safer, more open, and helpful to everyone, no matter their size or where they are.

DeFi Monetizes the Booming Gaming Industry

The gaming industry is booming, thanks to technology, easy access to the internet, and the love for online games. This growth is powered by tech advancements and the joy of playing with others online. It also comes from buying small game items, running in-game worlds, and the big push for esports.

Dynamics of the Gaming Industry

Gaming is now worth billions, making money from selling games, buying in-game stuff, subscriptions, and ads. Better technology has let us play more intense games on different devices. Playing with others online has made gaming a shared hobby, linking players worldwide. Esports has become super serious, with big contests and lots of money up for grabs.

Emergence of DeFi in Gaming

Mixing decentralized finance (DeFi) with games is an exciting way to use digital stuff for money, keep players hooked, and change how gaming works. DeFi brings cool things to games, like turning imaginary stuff into tradeable tokens, making markets where players buy and swap with each other, and rewarding them for playing and growing the game ecosystem with digital coins.

DeFi in games lets players swap digital things directly with each other. It makes trading easier and more clear. The play-to-earn idea in DeFi gaming gives players a reason to play more and help the game evolve. They get rewarded with special coins, opening up new chances to make money while playing.

The mix of DeFi and gaming is set to enlarge the sector. It’s predicted that blockchain gaming will jump by 68.3% yearly from 2023 to 2030. The whole online gaming world is also expected to grow by 13.4% in that period. A lot of money and interest are going in, showing huge chances for the future.

But, using crypto games comes with issues, such as hard-to-use systems and not being very open to all. Getting people educated and aware is critical for making crypto gaming more accepted. Players need to learn how to use special game coins, NFTs, and DeFi systems in games.

Integrating DeFi with Traditional Finance

The combo of decentralized finance (DeFi) with traditional systems is rapidly changing finance. This mix is getting more popular as traditional institutions start using DeFi’s tech like smart contracts and decentralized loans. Mixing old and new finance helps bring new ideas, better financial inclusion, and makes finance easier to use and stronger.

Big banks and the like can invest in DeFi projects, make big DeFi markets more steady and varied, and upgrade their investment plans. Joining hands with the rule makers lets DeFi play by the rules, increasing trust and making the financial system stronger. When traditional and DeFi finance come together, it’s a chance for new ways to manage risks, make better products, and meet the changing needs of folks worldwide.

| Opportunities in DeFi Integration | Challenges in DeFi Integration |

|---|---|

|

|

Mixing traditional finance and DeFi is a huge chance to transform money. This combo uses the best from both to make new things, bring more people into the finance world, and add value for everyone.

Restaking Protocols: Simplified Yield Farming

In the world of decentralized finance (DeFi), a key trend for 2024 looks to be restaking. It’s all about locking up your staking tokens to get more yield. This way, the journey of farming for yield and rewards becomes easier for everyone. Plus, it brings more benefits to those holding the tokens.

So, what are liquid staking tokens? These are your staked assets that can be easily traded or used in different DeFi platforms. They are more flexible and not tied down like with regular staking. Liquid restaking brought along Liquid Restaking Tokens (LRTs). Users can stake their assets and hop into more ways of earning within the DeFi realm. This adds to how fluid, efficient, and profitable the process becomes.

Diving into the leaders, both Etherfi and EigenLayer are making big waves in the scene. They have locked up funds worth billions. For example, Etherfi has locked up above $2.8 billion and even got a huge $23 million boost through a Series A funding round. EigenLayer, not far behind, stands at over $1.5 billion TVL. It’s known for its strong security features and financial smartness.

Thanks to liquid restaking, platforms like Ether.Fi and Puffer Finance are seeing a lot more action. Ether.Fi alone now holds a massive $1.2 billion, up five times in just a month. Puffer Finance is also doing great, hitting $970 million in deposits. This is a ten-fold jump in only three weeks. All this growth shows how quickly the field is expanding.

LRTs open the door to quick liquidity and entering DeFi markets for users. They let people grow their investments in various yield-creating ways. This method finds a good balance between network safety and fresh investment chances. It’s making it easier for new Ethereum stakers to join in, attracting a bigger crowd.

| Liquid Restaking Protocols | Total Value Locked (TVL) | Key Highlights |

|---|---|---|

| Etherfi | $2.8 billion | Successful $23 million Series A funding round |

| EigenLayer | $1.5 billion | Enhanced security and capital efficiency |

| Ether.Fi | $1.2 billion | 5-fold increase in deposits in one month |

| Puffer Finance | $970 million | 10-fold increase in deposits in three weeks |

The advent of liquid restaking has sparked new services, like Pendle. They offer reward strategies that have become quite popular. These strategies promise big shares of rewards, especially on platforms like Ether.Fi and EigenLayer. Although speculative, they surely are making heads turn and encouraging more deposits.

In summary, restaking is making the yield farming journey easier and more beneficial for stakers in the DeFi space. These innovative protocols are positioned to make a big impact. They will pull in more users, add to liquidity, and help DeFi grow in exciting ways in the upcoming years.

Stablecoin Evolution: Stability Amid Volatility

The world of decentralized finance (DeFi) updates and crypto changes will see big evolution in 2024. Stablecoins are at the center of this shift. They offer a safe way for people to use digital assets without the worry of crypto markets ups and downs. Decentralized finance has a big ally in stablecoins, making it more usable and reliable for all.

Today, new stablecoins are looking at more than just fiat money to back them. Some are using things like commodities or government debt. This mix of backing makes the whole stablecoin ecosystem stronger. Also, new ideas like algorithmic stablecoins and central bank digital currencies (CBDCs) help keep the crypto market steady.

| Stablecoin Type | Collateral | Decentralization |

|---|---|---|

| Asset-backed Stablecoins | Off-chain (Fiat) and On-chain (Cryptocurrencies) | Centralized and Decentralized |

| Algorithmic Stablecoins | Algorithmic Price Stabilization | Decentralized |

In the DeFi landscape, stablecoins are key for keeping things stable and liquid. They are important tools for lowering risks and saving money during market troubles. Stablecoins make trading in the crypto ecosystem fast and easy. They also make it more familiar with their fiat ties, welcoming more people to decentralized finance.

Decentralized Exchanges and Automated Market Makers

Decentralized Exchanges (DEXes) and Automated Market Makers (AMMs) have changed finance. They give users control, safety, and the chance to invest in many different things. The way DEXes and AMMs constantly improve and bring new ideas is very important.

Innovation in DEXes and AMMs

These decentralized exchanges and automated market makers keep getting better. They add new tools that make trading easier, increase the amount of money in the market, and allow for more things to be traded, like crypto lending platforms and stablecoin developments. There are now many different types of AMMs, like constant product market makers and hybrid function market makers, which help everyone find something that fits their needs.

Adaptability and Accessibility

Being able to change and be used easily is important for DEXes and AMMs. It helps more people join in with decentralized finance. Despite challenges, like DeFi regulations, they keep getting better and meeting what people want. Because they make trading easier and less risky for those providing money, DEXes and AMMs are very important in the world of blockchain financial innovations. They help us see the future of DeFi news and decentralized finance updates.

Decentralized Physical Infrastructure Networks (DePIN)

Decentralized Physical Infrastructure Networks (DePINs) are becoming an important DeFi trend for 2024. They use blockchain to change how we work with real-world stuff. By using tech like smart contracts and the Internet of Things (IoT), DePINs make it possible for things to communicate and take action on their own. This tech is big because it makes everything run better, clearer, and greener, from how we get around to how we use energy.

Revolutionizing Physical Infrastructure

Bringing DeFi and decentralized tech into real-world networks is a big leap toward making our digital and physical lives work together. The DePIN idea has really taken off. In the year between January 1, 2022, and January 1, 2023, 19 projects got, on average, $18 million each. Removing big numbers like Helium, the average was $5.9 million. A year later, from January 1, 2023, to January 1, 2024, DePIN project funds went up by 22%. During this time, 9 projects got, on average, $7.2 million each.

Smart Contracts and IoT Integration

In the first part of 2024, the DePIN world saw a lot of action. 26 projects raised, on average, $6.5 million. This shows that more people and businesses are interested in using decentralized tech for real-world projects. It’s not just about tech like Computing Power and Wireless Networks. We’re also seeing DePIN projects in areas like Health Data and Energy, proving that this tech can be used in lots of ways.

As time goes on, DePIN projects are getting smarter. They’re using smart contracts and IoT more. This lets things in the real world talk and work together on their own. It’s all about making stuff work better, clearer, and in a way that’s good for the planet. This opens the door for a future that’s more equal and spread out.

decentralized finance updates

The decentralized finance (DeFi) area is quickly changing. It includes many updates and new ideas that are changing finance. For example, DeFi is combining with traditional finance.

Apps in DeFi let people do financial things without banks. This includes lending, trading, and more. They offer better fees, high interest, and safety. A company like Aave gives decentralized lending options.

DeFi has seen a lot of growth lately. It has brought us things like Uniswap for trading. Its goal is to make finance without needing to trust other people. This matches what Bitcoin started as. It offers open access and is very transparent.

But there are issues in DeFi. There are risks like hacking and scams. Also, it can be hard to grow and there are many false claims. Despite these issues, DeFi keeps growing. It brings new ways to do finance.

| DeFi Sector | Description |

|---|---|

| Decentralized Exchanges (DEXs) | Platforms that facilitate the trading of cryptocurrencies and digital assets in a decentralized, peer-to-peer manner without the need for a central authority or intermediary. |

| Liquidity Provision | The process of providing cryptocurrency assets to DeFi protocols to create liquidity pools, enabling users to trade, lend, and borrow digital assets. |

| Lending/Yield Farming | Decentralized lending protocols that allow users to lend their cryptocurrency assets and earn interest, as well as strategies for maximizing yield on idle crypto holdings. |

| Gambling/Prediction Markets | Decentralized platforms that enable users to participate in gambling activities or make predictions on future events, with winnings paid out in cryptocurrency. |

| Non-Fungible Tokens (NFTs) | Unique digital assets, often representing artwork, collectibles, or in-game items, that are recorded on the blockchain and can be bought, sold, and traded. |

The DeFi world is always changing. This makes it important to keep up and be ready for what’s new. It’s also key to handle the changing rules and problems in the field.

Layer-2 Solutions and Crypto Bridges

The decentralized finance (DeFi) ecosystem is growing. Layer-2 solutions and crypto bridges have become very important. They help with scalability problems on blockchain networks. This makes transactions faster and cheaper.

Layer-2 solutions, like Rollups and Sidechains, reduce the strain on blockchain networks. This improves transaction time and lowers costs. Crypto bridges also make it easy to move assets between blockchains. This increases connectivity and creates new uses for DeFi.

These advancements improve how DeFi works. This opens the door for more people to join and for bigger investments. Layer-2 solutions, such as Arbitrum and Optimism, are changing DeFi. They are faster and cheaper than using the Ethereum mainnet.

Arbitrum can handle up to 4,000 transactions per second and cuts gas costs by 95%. Optimism makes transactions up to 26 times quicker and reduces gas fees by 90%. This is a big step forward for DeFi.

Layer-2 solutions are used beyond finance, even impacting gaming and supply chains. They make things faster and easier to join. Crypto bridges are key in making different blockchains work together.

Yet, there are challenges when connecting Layer-1 and Layer-2 networks. The $2.8 billion lost in DeFi hacks points to bridge-related problems. This shows the need for better security and ongoing improvements.

The DeFi ecosystem is changing fast. Layer-2 solutions and safe crypto bridges are vital for DeFi’s future. They will make DeFi protocols more accessible and better integrated, attracting more users and fostering innovation and growth.

Regulatory Developments and Compliance

The decentralized finance (DeFi) space is getting bigger. So, keeping an eye on rules and following them is key. Many countries work hard to set rules that mix new ideas with keeping people safe and making sure money doesn’t run into trouble. Making DeFi work well with old-school finance also leads to talks about having similar rules for both.

DeFi teams up with the rule makers to be in line with what’s already out there. This helps build trust in the bigger finance world. In 2023, more than 20 places made whole sets of rules for crypto. This shows that the world over, people want to make a safe space for new financial ideas.

The world of rules for DeFi is changing fast. Everyone in this space needs to keep up and be ready for new rules. Just in the U.S., companies paid fines up to $5 billion for not following the rules between late 2022 and almost 2023. This shows how important it is to play by the rules.

Decentralized Know-Your-Customer (KYC) can be a game-changer. It uses the blockchain to check who you are. It can make the process from slow to super fast. This way, people get to share their info in a safer and better way. It’s good for everyone because it makes things faster and more secure with lower costs.

But switching to this new KYC way is not easy. There are a lot of challenges to deal with. Things like safety worries, following the rules, getting these new ways to work together, and getting people to use this new system. As DeFi grows up, finding good ways to tackle these hurdles will be very important for its future success.

Conclusion

The decentralized finance (DeFi) sector has changed a lot. It has moved beyond just being a risky idea. Now, it’s more organized and reliable. DeFi is mixing with regular finance and using new tech like Layer-2 solutions. It’s also forming networks for physical spaces and improving digital money handling.

As DeFi and regular finance come together, big changes are happening. This mix could completely transform how we see money. It promises to bring new ideas, include more people, and add value for all. The recent DeFi advancements show the big impact this tech can have on the financial world.

DeFi is moving fast. New ideas and changes are happening all the time. It links with traditional finance and introduces new tech. This is opening up better ways for people to deal with money in clear, safe, and easy ways.

FAQ

Q: What is Decentralized Finance (DeFi)?

A: Decentralized Finance or DeFi changes the financial world. It uses blockchain to make finance open to all by cutting out the middlemen. This makes finance more fair, clear, and fast for everyone.

Q: What are the key principles driving the growth of DeFi?

A: DeFi is growing because of its focus on being open, safe, easy to use, and available to all.

Q: What are the advantages of DeFi over traditional financial systems?

A: DeFi is way better than traditional finance in many ways. You pay less and deal with your money faster. You also control your money more and can use many financial tools without lots of paperwork.

Q: How does the convergence of traditional finance and DeFi present opportunities?

A: Traditional finance and DeFi coming together changes finance for the better. By mixing their best parts, we can all benefit with new ideas, more people being included, and better services.

Q: How can DeFi be integrated with the gaming industry?

A: DeFi and games fit well together. Game items can be turned into real money with DeFi. This makes games more fun and gaming can earn you money.

Q: What is the significance of restaking protocols in the DeFi landscape?

A: Restaking makes DeFi better by giving rewards to those who hold tokens. It’s becoming a big deal in DeFi and will be more important in the future.

Q: How are stablecoins evolving to provide stability amid market volatility?

A: More people want digital money they can count on. That’s where stablecoins are making big steps. They find new ways to be safe in the changing world of digital finance.

Q: What is the significance of Decentralized Exchanges (DEXes) and Automated Market Makers (AMMs) in the DeFi ecosystem?

A: DEXes and AMMs are changing how we trade money without needing a big trader. They bring freedom and safety to trading. Plus, they keep adding new things to make trading better.

Q: What is the potential of Decentralized Physical Infrastructure Networks (DePIN) in the DeFi space?

A: DePINs could change how we build things by using blockchain. They make building and using things smarter, clearer, and greener in many fields.

Q: How are Layer-2 solutions and crypto bridges impacting the DeFi ecosystem?

A: Layer-2 solutions and bridges make DeFi easier to use and join. They help solve big problems like too many users slowing things down. This makes moving money between different blockchains easier.

Q: How are regulators and DeFi platforms addressing compliance and regulatory developments?

A: People who make rules are working on fair rules for new finance. DeFi is helping follow these rules to build trust. This makes new finance safer and more trusted for everyone.