In 2022, a surprising 24% of new coins were likely scams, Chainalysis found. This shows how ups and downs are common in the cryptocurrency world. It’s a space where bubbles and manias are as normal as air and water.

Crypto bubbles happen when everyone starts buying based on excitement, not facts. These big price leaps happen outside of what coins are really worth. This article will walk you through what drives these bubbles, how they behave, and what they mean. You’ll get why these market storms happen and how they shape the world of digital money.

Key Takeaways

- Crypto bubbles are marked by prices shooting up quickly, emotional trading, and wild ups and downs.

- They can be a chance to make more money, but they also bring big risks of losing.

- Doing your homework is key to not getting swept up in the bubble.

- Knowing what causes these bubbles can help you play the market smarter.

- Adding crypto to your investments carefully can help balance out risks.

What is a Crypto Bubble?

In economics, a crypto bubble is when prices of digital assets surge beyond their real worth. This surge can happen when many people buy, creating a frenzy. Or, when the market wrongly believes the assets are worth more.

It’s harder to spot a bubble in the crypto world. This is because some assets like Bitcoin and altcoins don’t have a true or intrinsic value. So, we call a situation a crypto bubble when prices go way high, driven by speculation and hype, not by the assets’ real value.

Prices Far Exceed Intrinsic Value

Crypto bubbles make the prices of digital assets much higher than their real value. This big gap between the price and actual worth is a sign of irrational excitement in the market.

Driven by Speculation and Hype

Many things can spark a crypto bubble. Some common ones are the fear of missing out (FOMO), a lot of hype, and a belief that prices will only go up. This excitement often leads to bubbles that eventually pop.

Defying Market Fundamentals

During a bubble, asset prices may not match their real use or potential growth. This over-the-top excitement, or irrational exuberance, creates a big gap between what people think assets are worth and what they actually are.

Pump and Dump Schemes

In the cryptocurrency market, there’s been a rise in crypto pump and dump schemes. These are like mini bubbles that turn out to be scams. They work by using social media to make certain cryptocurrencies seem more valuable than they are, drawing in investors. Once the value is high, the scammers sell theirs, which makes the price drop drastically for everyone else.

Coordinated Efforts via Social Media

Pump-and-dump schemes have found their place in popular chat rooms like Discord and Telegram. Some groups have even reached 200,000 members. They pick smaller, lesser-known cryptocurrencies for their schemes, as these are easier to manipulate.

Prevalence in ICOs and NFTs

In the hype of initial coin offerings (ICOs) in 2017-2018 and more recently, non-fungible tokens (NFTs) in 2021, crypto pump and dump schemes became common. A study found that one in four new coins last year could be from these schemes. Their impact can be huge, with millions traded and investors losing tens of millions in a single year.

Cryptocurrencies That Plummeted to Zero

The crypto market has seen many big crashes, costing billions. The Terra network’s sudden fall in May 2022 was one of the worst. It caused a crypto winter, shrinking the value of Bitcoin by over 60% from its high in 2021. This wiped out the $18 billion value of UST and the $40 billion in LUNA, hurting investors badly.

Crash of Luna

The Terra ecosystem’s fall shocked the crypto world. It played a big part in the 2022 crypto winter, leading Bitcoin to drop from over $69,000 to about $19,000. This crash in value was massive, affecting many in the cryptocurrency market.

Collapse of FTX

FTX’s bankruptcy was linked to the LUNA crash. It was seen as a heavy hit to the market, making its already weak state worse. The fall of FTX added to the ecosystem’s problems, making it a tough blow for investors.

Bitconnect Ponzi Scheme

Bitconnect duped US investors into losing $2.4 billion in 2018. This Ponzi scheme’s value spiked from $0.17 to $463, marking a huge scam in crypto history.

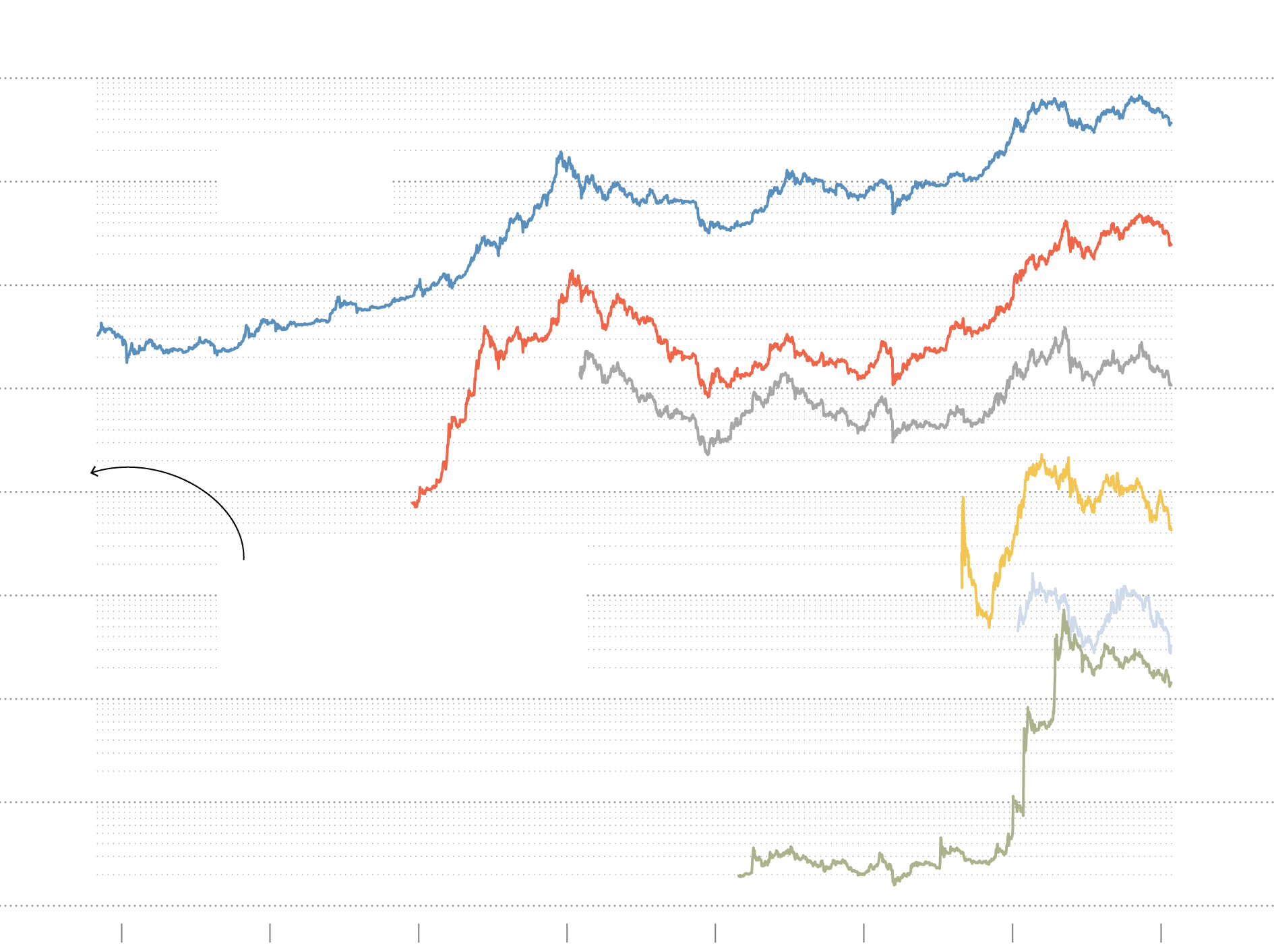

Bitcoin’s Major Bubble Cycles

Bitcoin has seen two big bubble cycles in its history. Each time, the price went way up, only to later drop a lot. These cycles have shown how wild and speculative the cryptocurrency market can be.

2022 Crypto Winter

In November 2021, Bitcoin hit a new high of over $69,000. But, it soon started dropping and didn’t stop for months, leading to what people called the 2022 crypto winter. The fall was partly because the Terra network, which includes the terraUSD (UST) stablecoin and LUNA token, went down. This crash affected the whole crypto world.

By June 2022, Bitcoin’s price fell to around $19,000. This was among the biggest price drops ever, said Bank of America.

2018 Selloff

In late 2017, a bull run in the crypto market caught lots of attention, including from the media and Wall Street. Bitcoin hit over $19,500 in December 2017 but quickly dropped to less than $7,000 in early 2018. This fall showed clearly how risky and volatile the market is.

| Event | Price Movements | Implications |

|---|---|---|

| 2022 Crypto Winter | Bitcoin fell from over $69,000 in November 2021 to around $19,000 in June 2022. | The 2022 crypto winter was triggered by the collapse of the Terra network, causing a widespread market sell-off and the fifth-largest wipeout ever, according to Bank of America. |

| 2018 Selloff | Bitcoin surged to over $19,500 in December 2017 before crashing below $7,000 in less than two months. | The 2018 selloff was the first major bubble cycle to hit mainstream media and attract the attention of Wall Street investors, highlighting the volatility and speculative nature of the cryptocurrency market. |

Identifying Potential Bubbles

Bitcoin is almost at its highest point ever. We might be seeing another bubble forming. While Bitcoin itself could be heading for a sustained increase, coins like Dogecoin are likely in a bubble. This is because they’re rapidly increasing in value but do not have much real use yet. cryptobubbles.net is an excellent source for spotting these bubbles early. It uses many signs to predict the possibility of a bubble.

| Metric | Description | Bubble Signal |

|---|---|---|

| Price Volatility | Measures the size of price changes | Big price swings could mean a bubble |

| Trading Volume | Looks at how many transactions are happening | A really high trade volume might point to a bubble |

| Market Capitalization | Finds the total value of a cryptocurrency | Too high a market cap might show a bubble |

| Margin Trading | Sees how much leverage is being used | More margin trading can help create a bubble |

Watching these metrics can help investors see bubbles before they burst. By keeping an eye on these signs, they can wisely choose their path in the chaotic world of cryptocurrencies.

crypto bubbles

A cryptocurrency bubble sees prices soar by tens or hundreds of percent fast. It’s driven by the fear of missing out (FOMO). High volatility makes for risky but tempting investments, leading to the bubble’s rise and fall.

Rapid Price Increases

Crypto bubbles are known for their fast price jumps. The values can rise quickly, losing touch with true worth. This sparks a buying frenzy based not on facts, but on hopes of quick gain, ending when the bubble pops.

Emotional Trading and FOMO

FOMO and emotional trading fuel crypto bubbles. Investors seek fast money, overlooking careful market study. They get pulled in by excitement and not by what the assets are really worth. This keeps the bubble growing.

High Volatility

Cryptocurrency markets swing wildly in value. While this can offer chances to win big in a bubble, it also spells risk. Misjudging the market or failing to control investments can lead to heavy losses.

Phases of a Crypto Bubble

The crypto bubble has its unique stages. Each has its effects on people who invest.

Ascent Phase

The start is called the ascent phase. Here, a crypto’s price begins to rise. Early investors buy in, thinking it will do well, making the price go up.

Euphoria and Boom Phase

Next comes the euphoria and boom phase. Prices keep going up, making everyone excited. The fear of missing out makes prices reach very high levels.

Profit-Taking Phase

Then we have the profit-taking phase. Signs to sell start showing. Smart investors sell, which slowly lowers the price. Euphoria fades as the market changes.

Panic Phase

Finally, the panic phase takes over. People fear the bubble will pop. The rush to sell causes prices to drop fast. Those who didn’t see the signs face big losses.

Capitalizing on Crypto Bubbles

Investors see the potential in cryptocurrency bubbles. Some use a risky but bold move called short selling during these times. This means they sell cryptocurrencies they don’t actually own before the bubble bursts. On the other hand, trend trading involves buying as prices go up, then selling when they think it’s a peak to make a profit.

Trading on Short Positions

Short selling in crypto bubbles is all about timing and smart analysis. If an investor can spot when a bubble is going to pop, they can make a lot of money. But, if they’re wrong, the losses can be big. That’s because they have to buy back the cryptocurrencies at a possibly much higher price to return them to the lender.

Trend Trading

Trend trading means buying when prices go up and selling at the perceived peak. It’s about understanding the market trends and having the discipline to get out at the right time. This approach requires a trader to know when to sell before the bubble bursts, which is very tricky.

Thorough Research

Thorough research is key before jumping into any trading during crypto bubbles. It helps traders make logical decisions rather than emotional ones. Knowing the market’s fundamentals and what could trigger a bubble’s collapse is essential. This kind of preparation is critical for success and risk management.

Benefits of Understanding Crypto Bubbles

The cryptocurrency market goes through up and down cycles. Understanding these cycles can really help investors. It gives them a better chance at success through smarter investing, learning more about crypto, and spreading out their investments.

Effective Investing and Trading

Knowing about crypto bubbles helps investors make better moves. They can see when these bubbles might form. This knowledge can help them make money through smart trading.

Self-Education

Learning about crypto bubbles is great for self-education. It teaches investors about the excitement, trends, and feelings that drive the market. This understanding can lead to smarter investment choices.

Portfolio Diversification

Using what you know about crypto bubbles can make your investment safer. It helps spread out the risk, so you can win even when bubbles pop. They can still make money despite the bubble’s risks.

Getting rich quick in a bubble might sound good, but it’s risky. Learning about bubbles helps investors avoid these dangers easily. It can lead to better decisions, less risky trading, and a better future in the crypto world.

Risks of Crypto Bubbles

Crypto bubbles bring serious risks, such as losing a lot of money. Prices can change very quickly, and this can hurt people’s investments. For those who aren’t careful, these up-and-downs can take away much of their money.

Since it’s hard to predict what will happen, even experts find it tough. This makes navigating through these bubbles very difficult for anyone.

Potential for Significant Losses

Investing in crypto bubbles can lead to big losses. People have lost everything they put in during just one week. At the peak of these bubbles, prices can get extremely high, beyond what the assets are really worth.

And when the bubble does pop, prices can fall very quickly. This can take away a lot of the money people had invested.

Volatility and Uncertainty

Cryptocurrencies are not yet fully accepted and are not regulated. They can have very unstable prices. High prices, quick investments, and little real-world use are signs of a bubble. Also, when many people don’t really understand crypto but still want to invest, it’s usually a bubble.

This kind of situation is tough for experienced investors. The uncertainty and unstable prices make it a risky place to invest in.

Lessons from Crypto Bubbles

Crypto bubbles come and go, but they teach us a lot. They show how important it is to do your homework. This means knowing the tech behind cryptocurrencies and their core values. It also means looking at investing for the long haul, not just for quick wins.

Importance of Thorough Research

It’s key to really look into cryptocurrencies before buying. Knowing about past bubbles can guide you. It helps you steer clear of making choices based on excitement or the fear of missing out (FOMO).

Understanding Underlying Technology

To do well in crypto, you need to really understand its technology. Learning about blockchain, how it’s decentralized, and what makes each coin unique is vital. This knowledge helps you choose wisely, looking beyond just the current price.

Long-Term Investment Mindset

Thinking long-term in crypto is tough but important. The market’s ups and downs can be tempting. But staying patient, focusing on basic values, and aiming for growth can pay off in the end.

Conclusion

Crypto bubbles are now a big part of cryptocurrency trading. They bring big price swings and a lot of ups and downs. People join in because they see others making money. But, it’s important to be smart and not get carried away by all the excitement.

Learning about how these bubbles work means you can make better choices. It’s smart to spread your investments around. Also, learning from past bubble bursts is key. Doing your homework, knowing the tech behind it, and thinking long term can keep you safe.

The crypto world keeps changing. Understanding and studying these bubbles is still new. By staying on top of the latest research, you can make better decisions. This will help you handle the ups and downs of the crypto market better. So, you might just be on your way to successful investing.