Introduction:

The cryptocurrency industry has witnessed remarkable growth and evolution in

recent years, attracting widespread attention from investors, tech enthusiasts,

and financial institutions. As we enter the year 2023, it’s crucial to explore

the emerging trends that will shape the future of the crypto landscape. In

this blog post, we will delve into the key crypto trends to watch in 2023 and

discuss the potential directions the industry may take.

Intense

Battles Over Crypto Regulation

Regulatory scrutiny surrounding cryptocurrencies has been on the rise, and 2023

is expected to see even more intense battles over crypto regulations.

Governments and regulatory bodies around the world will grapple with striking

the right balance between protecting investors and fostering innovation within

the industry. The outcome of these debates will have a significant impact on

the future direction of cryptocurrencies, potentially affecting market

performance and investor sentiment.

Continued

Growth of Web3 Platforms

Web3 platforms, built on blockchain technology, are gaining momentum and

transforming various sectors. In 2023, we can expect to see a further surge in

the adoption and development of decentralized applications (dApps)

and blockchain-based platforms that offer enhanced security, transparency, and

user control. This growth will be driven by the increasing demand

for decentralized solutions in industries such as finance, supply

chain, and data storage, among others.

Potential

Market Downturns and Volatility

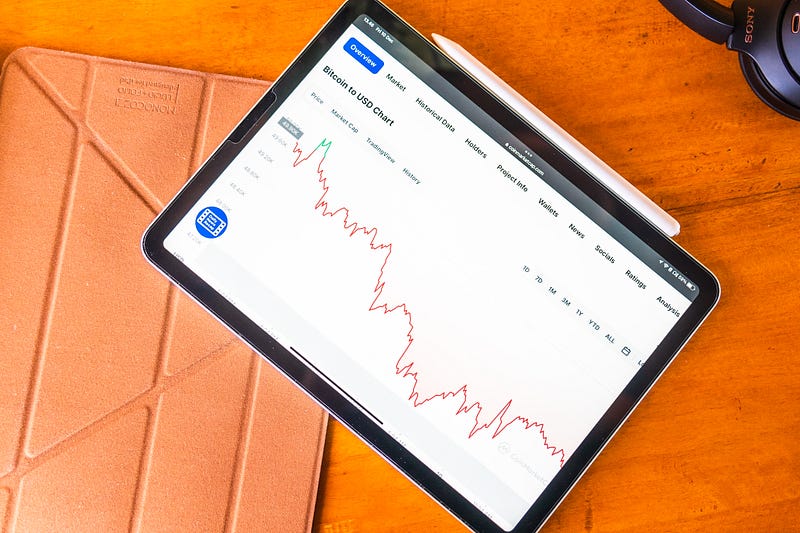

The crypto market has always been prone to volatility, and 2023 may witness

periods of market downturns and price corrections. Investors should remain

cautious and prepare for potential fluctuations, as the market continues to

mature and stabilize. This volatility may also present opportunities

for savvy investors to capitalize on market shifts and acquire

promising digital assets at attractive valuations.

Global

Bitcoin Adoption

Bitcoin, the pioneer cryptocurrency, continues to gain traction worldwide. In

2023, we can expect to see an increase in global bitcoin adoption as more

individuals, institutions, and countries recognize its store of value

properties and potential as a medium of exchange. This will be supported

by growing acceptance of Bitcoin as a legitimate financial instrument, as well

as ongoing technological advancements that make transactions faster,

cheaper, and more secure.

Diversification

Outside the Crypto Sphere

As the crypto industry matures, we are likely to witness diversification beyond

traditional cryptocurrencies. Non-fungible tokens (NFTs), tokenized real

estate, digital art, and other alternative asset classes will

gain prominence, providing investors with new avenues for portfolio

diversification. These alternative assets offer unique investment

opportunities and can help investors hedge against market risks and potential

downturns in the crypto sector.

Fashion

and Web3 Intersection

The intersection of fashion and Web3 technology is a trend to watch

in 2023. Fashion brands and designers are embracing blockchain and NFTs to

create unique digital fashion items, tokenized collectibles, and

innovative ownership experiences for their customers. This fusion of fashion

and technology will drive new business models and revenue streams, as well

as transform the way consumers interact with fashion brands and express their

personal style.

Enduring

Significance of NFTs

Non-fungible tokens (NFTs) made headlines in recent years, and their

significance is expected to endure in 2023. NFTs will continue to revolutionize

the art world, gaming industry, and digital collectibles market, offering new

avenues for creators and collectors to monetize and trade unique digital

assets. As the NFT market matures, we may also see increased standardization

and interoperability, making it easier for users to manage and trade their

digital assets across different platforms.

Rise

of Gaming and Decentralized Autonomous Organizations (DAOs)

The gaming industry is poised for significant growth in 2023, fueled by blockchain

technology and decentralized applications. Gamers will benefit from greater

control over their digital assets, as well as new forms of in-game monetization

and social interaction. Furthermore, Decentralized Autonomous

Organizations (DAOs) will gain traction, allowing communities to govern

and operate platforms collectively, fostering a new era of decentralized

governance and decision-making.

Disaggregation

of Exchanges

The crypto exchange landscape is expected to witness a trend of

disaggregation, where different services traditionally offered

by centralized exchanges are unbundled and provided by specialized

platforms. This disaggregation allows for greater choice, customization, and

competition within the crypto trading ecosystem, leading to

better user experiences and more efficient markets.

Industry

Regrouping, Rebuilding, and Regaining Trust

In the wake of recent controversies and regulatory challenges, the crypto

industry will focus on regrouping, rebuilding trust, and adopting best practices

to enhance transparency, security, and user protection. Establishing robust

self-regulatory frameworks and industry standards will be crucial for

long-term sustainability and widespread adoption. This process may also involve

increased collaboration between industry players, regulators, and consumers to

ensure a healthy and vibrant crypto ecosystem.

Conclusion:

As we look ahead to 2023, the cryptocurrency industry stands at a pivotal

juncture.While the path forward may be marked by regulatory challenges and

market volatility, it also offers tremendous opportunities for innovation,

disruption, and the transformation of various sectors. By keeping a close eye

on the trends mentioned above, investors, enthusiasts, and industry

stakeholders can navigate the evolving crypto landscape and stay ahead in this

exciting digital frontier. As the industry continues to mature, we can expect

the emergence of new technologies, platforms, and use cases that will further

cement the role of cryptocurrencies and blockchain in our digital future.

Embracing these changes and adapting to the shifting landscape will be key to

thriving in the world of crypto in 2023 and beyond.